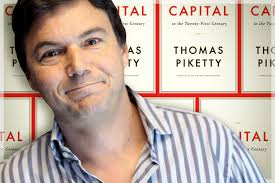

Capital in the 21st Century. Considerations on Thomas Piketty and inequality as manifest destiny

09/07/2014

Capital in the 21st Century

Considerations on Thomas Piketty and inequality as manifest destiny

Paula Bach

Economist, Karl Marx Institute - Argentina

Originally published in Ideas de Izquierda 10 www.ideasdeizquierda.org

Thomas Piketty’s book Capital in the 21st Century has reached second place on the Amazon bestsellers list, and third on the The New York Times’ list. According to The Guardian “Carrying it under your arm has, in certain latitudes of Manhattan, become the newest tool for making a social connection among young progressives.” The book that some consider the counterpart of the Fukuyama “moment” that took place more than a decade ago, and which is suggestively known just as “Capital” in the US, has generated an overwhelming variety of reviews from every position of economic theory. In the context of the ideological emptiness in bourgeois theory created by the Great Recession, it is by no means coincidence that Piketty’s book, which focuses on the dynamics of inequality in the capitalist economy, has become a significant political event, especially in Anglo-Saxon countries, and particularly in the US.

A machine producing inequality

If there is anything surprising about Piketty’s work, considering he is an economist who subscribes to mainstream economic theory, it is that throughout his exhaustive empirical research spanning from the eighteenth century until today, it identifies capitalism as a mechanism that inherently produces inequality. More than one hundred years after the famous debate within the German Social Democratic party, Piketty offers, unintentionally perhaps, convincing evidence in favor of Marxists like Rosa Luxemburg, who clashed strongly with Bernstein’s revisionist position. Bernstein postulated, among other things, that capitalism moved towards a less unequal distribution of property and a sustained diminishment of social contradictions.

A recurrent idea in the more than one thousand pages of the French edition of Capital in the 21st Century is that throughout history, capitalism shows a clear tendency to increase private wealth, concentrating property at one pole, and repeatedly increasing social inequalities. Only great shocks like WWI and WWII, the Russian Revolution in 1917, and the Great Depression of the 1930s–as historical exceptions–reduced inequality. But inequality resumed as an increasing trend in recent decades, with the inequality found at the beginning of this century reaching levels not registered since the Belle Époque.

Piketty claims that between 1900 and 1910, private wealth was between 5 and 7 years of national income in the largest European economies and the US, respectively. In the context of low demographic and economic growth, which Piketty considers a normal trend in a capitalist economy, inequality rose as it emerged a “patrimonial” capitalism. The increase of inequality would probably have continued until reaching inconceivable levels if great shocks had not taken place between 1914 and 1945. After this period, as a byproduct of the direct destruction provoked by the wars, economic and political shocks, as well as the low prices of assets after WWII, private wealth fell steeply, representing the equivalent of three years of national income. As a consequence of the destruction of wealth and the establishment of very high levels, in historical perspective, of progressive taxation, inequality diminished abruptly and initiated a period of rebuilding of European economies in which growth rates were exceptionally high, especially in Europe, in comparison with the previous history of capitalism. In this period, Piketty gives great importance to the emergence of a “patrimonial middle class” (essentially home owners) who represented the forty per cent located between the ten per cent of the richest and the fifty per cent of the poorest. In the years after WWII, this middle class owned between one-fourth and one-third of the national wealth in many European countries and the US. The growth of this social stratum is the main structural transformation in wealth distribution of the twentieth century.

Piketty insists on the fact that the low concentration of capital, high average economic and demographic growth rates, and the decrease of inequality after the war, constitute a clear exception in capitalism’s history. The norm is low growth rates, high accumulation of private wealth, and increasing inequality. Only shocks “external” to the economic system, originating from political events such as wars and social upheaval (although the latter plays a minor role in his analysis), were capable of reverting these conditions, though only for a limited period of time.

Thus, after the war, the rebuilding of private wealth occurs rapidly, and it accelerates during the “conservative revolution” initiated in the late ‘70s and early ‘80s. Average growth rates diminished, globalization and competition between nations to attract investment extended tax reductions, and above all, created a regressive taxation. As a consequence, net private wealth and inequality reached levels not seen since the beginning of the twentieth century. Net private wealth amounts today to between five and six years of national income. Regardless, as a legacy of the exceptional postwar conditions, a middle class proprietary stratum still holds, although threatened by an impoverishment that will generate strong political reactions.

At the same time, Piketty points out that, particularly since 1990, we observe a persistent increase in income inequality marked by the impressive growth of managers’ wages. This trend can be observed in most countries around the world, but it was particularly extreme in the US (which today is clearly more unequal than any European country), where tax reductions allowed inflated manager compensation. Under these conditions, Piketty warns that the prognosis of low economic growth in the next decades would lead to a more rapid increase of private wealth, accompanied by the development of a society where rents play a bigger role, reproducing, under the mark of the 21st century, the unbearable tensions of the Belle Époque.

The reign of dead labor

Piketty’s empirical research documents the historical evolution of private wealth: its extreme accumulation required in the first half of the twentieth century (which could happen again), and its massive destruction–two world wars and the depression during the ‘30s–as a precondition for the “thirty glorious years” that followed. His study, although based on “common sense” neoclassical postulates, provides suggestive insights which are very useful, at least as a guide, to analyze and evaluate on empirical grounds the evolution of what Marxists conceive as the tendency towards an over accumulation of capital and its consequences throughout history. But, how does Piketty explain the trends he observes? He does so appealing to what he defines as the wealth divergence mechanism.

According to this mechanism, throughout history (with the exception of the unique postwar period) it is possible to verify that the return on capital is persistently greater than the economic growth rate in most societies. So, it is enough that owners of capital invest a small amount of their earnings–slightly greater than economic growth–for the accumulation of wealth to exceed economic growth. Under these conditions, inherited wealth will predominate over earned wealth. The differences between private states and of a society of rentiers, who live off the difference between the investment and the earnings, develops side by side. Thus, the breach between return on capital and economic growth in Piketty’s analysis is the main force of inequality under capitalism. His goal is to show that the foundations of inequality are not to be found in the essence of capital itself, nor in the origin of profitability (surplus value), but in the emergence of a society of rentiers and the weight of inheritance, both derived of the difference between economic growth and return on capital.

To do this, Piketty postulates as an extreme speculative hypothesis the equality of economic growth and profitability, concluding that in this case the capital owner should reinvest every year the totality of her earnings on capital invested. Under these conditions, rentiers would have nothing left for consumption, because no amount can be separated from the yearly rents if they desire that their capital grows at the same rhythm of the economy, requisite for them to maintain their social status. Therefore, the value of net assets constituted in the course of a lifetime would be compatible with “meritocratic values” and “principles of social justice fundamental to modern democratic societies.” In Piketty’s own words, it “was the postwar social-democratic ideal: profits should finance investment, not the high life of stockholders.” The problem is that the fundamental source of inequality is not found in uninvested rents, or in the accumulation of capital of diverse magnitude, nor in the “conditioning” of inherited capital. The foundation of inequality in capitalist economy is capital itself, which is not an “object”, that is, the same as wealth, as Piketty treats it, but a social relationship in which unpaid living labor is the only element capable of increasing the value represented by dead labor contained in the initial capital, making it possible to increase accumulation. There is no “meritocratic value” capable of breeding capital: as much as the owners of the means of production and their managers try, they don’t have any other way of increasing the value of capital other than unpaid living labor. “Original” inequality regarding ownership of the means of production is a necessary condition for the reproduction of capital. It is in the expanded accumulation of capital, and not in the trends of consumption related to high concentration of wealth, where the root of inequality is to be found. Besides, the dynamic of capital accumulation itself generates the “rentier” and the concentration of capital, and thus inequality in wealth distribution. That is why the “principles of social justice fundamental to modern democratic societies” privilege the right of private property that is inherently linked to the existence of a class that has no access to the means of production, forced to sell themselves as labor power, the only commodity that is capable of providing the substance that increases the value of capital. We don’t inhabit the reign of the dead (the weight of inheritance), which, as Piketty suggests, dominates the world of the living; we inhabit the reign of private property of dead labor (means of production) that dominates the world of living labor (wage labor).

Piketty’s refusal to treat capital in its historically limited character prevents him from developing a theory of capital’s history. That is why in his work there are not even some elements of a theory that provide foundations for explaining capitalist crisis or the necessary condition for capital to overcome them.

A new war, a new tax?

After illustrating capitalism’s trends during its whole existence, demonstrating with impressive data how in more than two hundred years, the poorest fifty per cent of the society never accounted for more than five per cent of national wealth; or that at least two world wars and a catastrophic crisis were necessary to create the possibility for the forty per cent located between the richest ten per cent and the poorest fifty per cent to own homes in the richest capitalist countries; Piketty found this regularity through an empirical condition–the distance between return and growth–for which he offers no explanation.

The truth is that Piketty avoids the postulation of any internal law in capitalism that could explain the inequality he documents; his goal is to show that despite the increasing inequality it breeds, capitalism is the only possible, natural form, of human existence. That is why in his analysis economic growth appears as some kind of Deus ex machina, that does not depend on the return on capital or the will of capitalists, just as the rate of return appears as an entelechy with no more explanation than that of an accounting identity. For the same reason, by identifying capital with wealth, Piketty treats capital not as a social relationship, but as a thing, which has the useful or natural property of offering a return.

Following the same logic, when Piketty describes the increase of income inequality during the last thirty years, he points out the concentration of income at one pole, but pays no attention to the continued offensive of capital against labor. Piketty seeks to grant the force of a law to the difference between return on capital and economic growth, and actually opposes it to the law of the tendency of the rate of profit to fall that Marx explains in Volume 3 of Capital–presenting a remarkably poor critique of this tendency that has already been empirically refuted. His claim that the source of the increase in inequality is explained by the significant and lasting divergence between the rate of return of capital and economic growth rate, serves the primary purpose to create a basis for the economic policy he proposes. After repeatedly pondering if another world war will be necessary, pointing out that this time, it would be truly global, Piketty proposes as an alternative to reduce the breach between return on capital and economic growth through the establishment of an international record of estates and the application of a modest global progressive tax on wealth: a tax of 1 to 2% over total net assets, which in the case of the European Union would correspond to 2% of GDP. This is in fact an unexpectedly timorous policy that does not go beyond the goal of “putting the rentiers in their place” to stimulate the development of productive capital. It lacks originality with its resemblance of the Tobin rate, which beside its harmless features, has suffered many cutbacks and was postponed in the EU until 2016. We have to say that Keynes, who also had the reactionary utopian perspective to reproduce the benefits of war in times of peace, and who regardless of his extreme conservatism, was at least notoriously more audacious.

The unbelievable proposal of replacing the destructive role of world wars and capitalist crisis with a simple tax makes the contrast between the empirical findings of Piketty and his politics to jump into view as a problem in the logical structure of his work. It is true that “the difficulty arises because the economic analysis of income distribution is based on a neoclassical approach that by definition is asocial and not historical.” It is evident that Piketty does not reach any conclusion on the relationship between the huge historical events of the twentieth century that he studies and the limits of capitalism. He does not give much importance to his own findings on the massive destruction of value of capital in relation to the strong increase in profitability after WWII. In the same way, if we take up again what Piketty calls the “post-war social-democratic ideal,” we will not find in his book another reason–beyond time and chance–that explains why the “wealth divergence” filtered into the “social-democratic ideal,” putting an end to the “Glorious Thirties” and making way again for the “norm” of capital.